Intro

Tuesday

SPY neutral.

QQQ has $2B in trades at 364. That is our pivot for tomorrow.

Macro stock trend down on a flat day, could be selling.

Realtime prints very large TSLA SMH

SMH very large trade. Watch 149.30. Large SMH trades / levels will often tell us which way the market is headed.

TSLA trades all day long amounting to $1.2B. At the lows, I’d say buying. Here, I’m on the fence and not sure if these trades are buying, selling, or both. Probably both which isn’t all that helpful.

Close prints neutral.

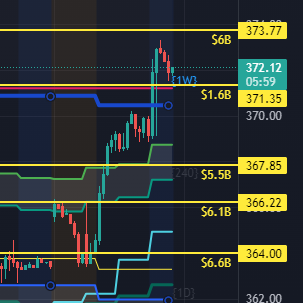

For tomorrow, watch QQQ 364 and SMH 149.30. One thing to worry about is NVDA earnings after the close. Hopefully NVDA is a big nothing and the market just goes on about it’s business. Remember we have a base of $13B SPY down at 433, too. SPY continues to float over the high volume trade box in the chart below.

Wednesday

Here’s a recap from the past week:

Thursday: Price is very far from the mean right now, which tends to cause a bounce.

Friday: Bounce

Monday: What typically happens next is a retrace of some degree. I’m starting to see a few tickers trying to set up for swing trades.

Tuesday: 50% retrace. For tomorrow, watch QQQ 364 and SMH 149.30.

Today SMH and QQQ levels held, and we got a very nice rally.

Over the past week, paid subscribers got a sneak peek of the market roadmap complete with levels to check if that roadmap was right or wrong. Sometimes the boys give us good clues and sometimes not. This week, the clues were outstanding.

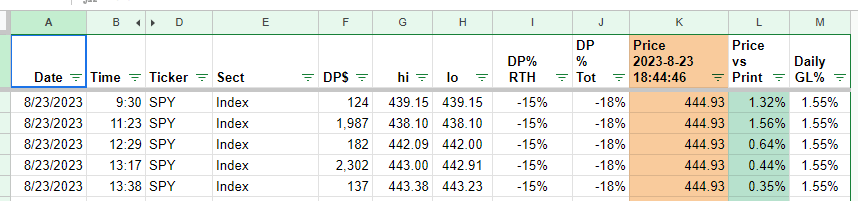

SPY PRINTS

Neutral.

Keep reading with a 7-day free trial

Subscribe to RollsRoyce’s Darkpool Trading to keep reading this post and get 7 days of free access to the full post archives.