Intro

Tuesday

SPY & QQQ over pivots with more volume coming in at around the same spot. Keep watching those like a hawk.

Realtime prints look like typical buying pattern. Does not mean the market goes up (or down) tomorrow.

Close prints are neutral. Would rather see these heavy at the lows (sneaky buying).

Many times this year, the boys bought on a day like today and then took the market down the next day to buy more. They will sometimes buy and draw down a few percent. The longer the market goes sideways here, the more likely we get a lasting low.

I’m not bullish yet. It would be nice if the indexes just stayed here for a while and built a base. Regardless of how I feel, if we start leaving those pivots to the upside, I get bullish again. If we drop under them in a hurry, bearish. Sitting here on the prints for a couple more days with heavy realtime / close prints would also be bullish.

Wednesday

Before we get started, everyone gets the QQQ data today, including the free Substackers. Time for a little Christmas cheer and time for another darkpool lesson.

If you learn one thing from me, only one thing, learn how to use the darkpool levels as a pivot. I will say over an over and over and over again that any bias I have as a trader gets thrown out the window by price action at major levels. I’ll say it again, price action at the pivots is far more important than bullish or bearish bias.

QQQ gave us the perfect lesson today on how the levels work. Yesterday, price “hugged” the level and consolidated all afternoon. That means the level is important and traders should pay attention and watch. In the afterhours session they just let price float up over the levels (bullish). Then this morning everyone probably panicked when price dumped down. Look where they stopped selling. Right on the 269 level. That green candled wanted one last kiss goodbye before heading back up. When price comes down to touch the print and immediately goes back up, that is SUPER BULLISH. Darkpool traders were scrambling to hit the “Buy Mkt” button on a bunch of NQ after coming down through the level and immediately rejecting. Those greenies were a bit more than 150 points today if you only took the ride up to resistance. A single MNQ on that train ride would be $300. Look at where price stopped. Right on the 274 level.

I gave paid subscribers the 269 level on Tuesday and the 274 level on Friday, so that is plenty of time to draw the levels on your chart and map out a trade strategy. One of my friends who goes by @blondebroker1 on Twitter, always says you need a plan. She is very talented and great at drawing harmonic patterns and worth a follow BTW. That plan she talks about always includes where you get bullish and where you get bearish. Map out each scenario. Set alerts on your charting platform. If I were home watching QQQ this morning instead of goofing off, that 269 level was a no brainer. I would have loaded the boat with MNQ’s. I might have even let one go coast to coast (yellow line to yellow line).

SPY PRINTS

$2B more at the lows which make about $8.7B around 380. That level is our new base and cannot break for bulls.

$4B at the highs. New pivot at 386.2141. In a normal uptrend, you don’t see $4B at the high of the day. You see a couple. Good chance those are sells. Does that mean we go down right away? Only if they are done selling.

MACRO TREND

The macro trend is computed from trades > $40M. SPY shot up 1.7%. The macro stock trend is only up 0.18%, so most of the trades are at the highs today. Do you think the boys at mission control bought or sold the highs today? Watch the pivots for your answer.

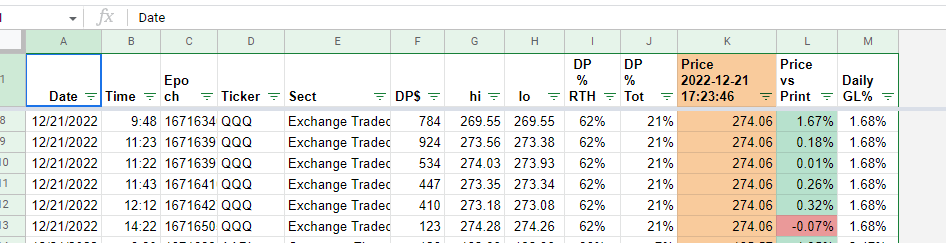

QQQ PRINTS

More from yesterday at the 269 level making a total of $4.4B that is your base.

Another $2.4B at the highs today, more than usual for a bullish uptrend.

If you are a free subscriber, consider trying out the paid version. I typically bring this up when something big happens in the other sections like the QQQ levels today. The paid version includes QQQ levels, close prints, high volume megacap trades, and a quick summary of the day. Right now, monthly price is $12 bucks. You’ll easily know in a month if you want to keep going.

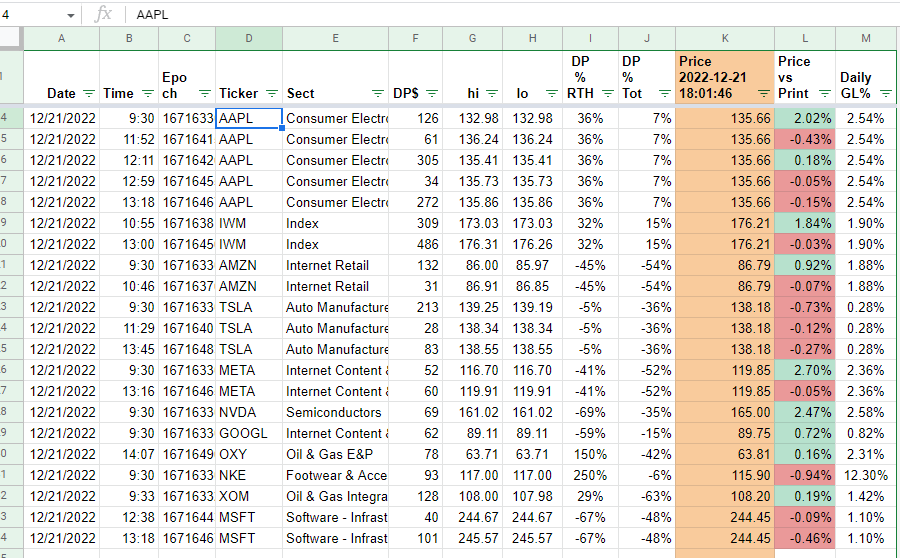

LARGE PRINTS

Where are the heavy levels? At the highs. $672M AAPL.

But price didn’t stay at the lows long enough for them to buy, right? Wrong. If they wanted to buy more today, the algos would hold price down for longer. I’ve seen giant 9:30 trades before. The 9:30 trades today are tiny.

UNUSUAL PRINTS

All the main indexes hit the “unusual” print bucket. That means the trades exceeded the 30 day moving average. Some of those trades in the sheet below are from yesterday. Darkpools can show up 24 hours late.

Today’s trades are at the highs. A lot of volume at the highs.

CLOSE PRINTS

Neutral

SUMMARY

They took the market up over the pivots today. It always amazes me that the sell algos all turn off at the same time like they talk to each other. Can’t be one company running all the HFT’s, but they all work together.

Realtime prints look like selling the highs today. Can those be buys? Yes, but not likely. Keep using the levels as a guide. Remember, levels are more important than bias.

Macro trend looks like silent distribution.

Close prints neutral and likely not buying the way up.

Hope everyone enjoyed the lesson on QQQ and using pivots. Leave a comment if you have any questions. I’ve seriously considered making a series of videos to teach how to trade darkpool levels. May be one of my 2023 goals.

Rolls