Intro

Monday

SPY & QQQ have higher volume at the highs than lows. Bearish.

Realtime prints high volume AAPL (again), META. Likely selling

Macro trend flat.

Close prints high volume TSLA META.

From Friday: What usually happens next? Watch for SPY to keep curling over then forming a lower high. My advice would be to take profits on trades that are well into the green and move up stops. It may not be the best time to enter new long or short positions until we see what they are going to do.

Tuesday

What happened today is very unusual. Giant gap up in the premarket with virtually no pullbacks. The Russell 2000 shot up 5.5%. In fact, this entire rally has only see one SPY pullback with any depth. I doubt that many traders were expecting a rally of this scale today.

So how do you trade a day like today? If I were a day trader, I probably would have shut my computer off and done something else. Chasing a violent rally comes with quite a bit of risk.

What about a swing trader?

Swing trading is the style I’m most comfortable with. My favorite position is one that is held for a few days to a few weeks. I’ll show you how I’ve played this market so far:

On 11/1, I loaded the boat with TSLA at 196 when I suspected that the investment banks were doing the same thing. I also loaded IWM at 163.60 very heavily. Why? Easy, I’d seen massive IWM trades in the same range for a week. TSLA was a laggard in the megacaps and seemed like the one with the most potential.

After 11/1, I didn’t see many large TSLA trades, and I saw over $1B in what looked to me like buying. I held on for dear life in the pullback (it wasn’t easy).

I unloaded half my IWM at 174.53. It seemed too good to be true. Then, IWM pulled back again, and I reloaded at 167.27.

I bought more TSLA at 207.52. Now I have oversize positions in IWM & TSLA.

I sold the TSLA tranche from 207.52 yesterday at the highs, and another half TSLA in the premarket today. I also sold a tranche of IWM in the premarket today.

I still hold positions in IWM & TSLA. Why? I haven’t seen what looks like heavy selling in either yet. Then why have I been selling tranches? There’s a joke in Kentucky that you’re supposed to vote early and often. That advise applies to trading. Remember I’m using the same exact data that you guys get in this newsletter. If you think that the investment banks (aka “The Boys At Mission Control”) are loading at the bottom of a trend, that can also give you confidence to do the same thing. You can use a strategy to buy at the lows, or incrementally buy in an uptrend. You can then sell your position in pieces, which I call tranches. Early and often LOL. If you have confidence that the big boys haven’t sold everything, you can hold part of the position and either a) stop out at breakeven b) set a trailing stop -or- c) hold for a higher target. They usually give you a good opportunity to buy the lows and sell the highs.

Exactly where I buy and sell is a little outside the scope of this newsletter. If you are interested in learning more about the methodology I use, you can get a free trial at FlowTrade.com and learn a lot more.

It also helps that my IWM levels have been hitting almost to the penny, which makes them very easy to play. Paid subscribers have been getting these levels daily for that very reason.

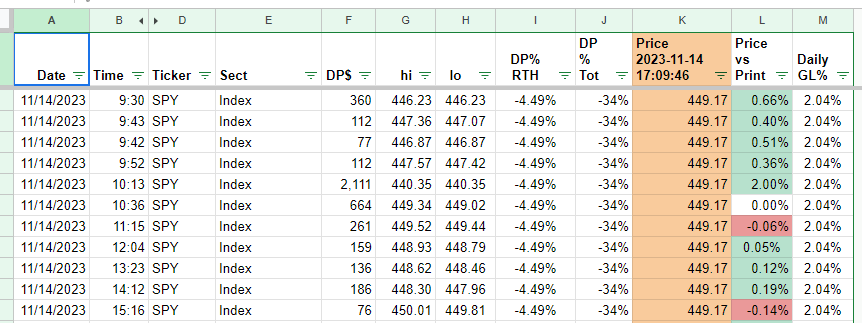

SPY PRINTS

About equal trades and the lows and highs. Neutral.

Keep reading with a 7-day free trial

Subscribe to RollsRoyce’s Darkpool Trading to keep reading this post and get 7 days of free access to the full post archives.