Intro

Wednesday

SPY has more prints at the lows than the highs. Watch 438.55. SPY is about $1 away from the phantom print and the A=C 1.27 fib extension.

QQQ has very little volume at the lows.

IWM trades appear to be heavy selling.

Realtime trades bearish.

Macro trend bearish.

Thursday

Let’s take a look and see what the market makers have been doing.

Thursday 9/14: Zoom up day after several days of consolidation. Most thought we were heading back up, but the boys were selling.

Friday 9/15: Dump 1.5% into Opex day. Bulls from 9/14 are trapped

Monday 9/16: Nothing

Tuesday 9/17: The boys created a “V Bottom”. Many traders would have seen this as a bullish “inverse head and shoulders pattern.” Another trap.

9/18 - 9/19: 2 dump days in a row

Something to remember. The market makers can paint anything on the chart that they want.

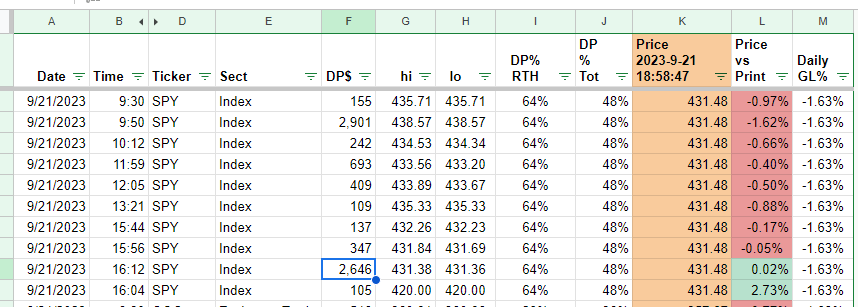

SPY PRINTS

Data today does not look like they bought the bottom.

Keep reading with a 7-day free trial

Subscribe to RollsRoyce’s Darkpool Trading to keep reading this post and get 7 days of free access to the full post archives.