Note From Rolls

Billing will start back up Friday (tomorrow) morning. I’m guessing the retro levels will be filled in and published some time later on Friday. If you’re new, Friday would be a good time to start a free trial.

If you’ve enjoyed the free content this week, leave me a comment on Twitter or Substack.

Intro

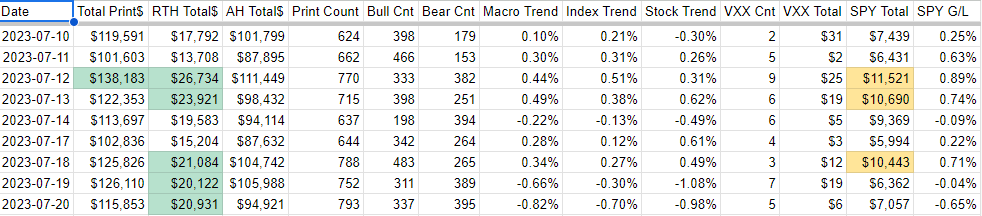

Wednesday

SPY under important level. Bearish. Keep watching 454.10

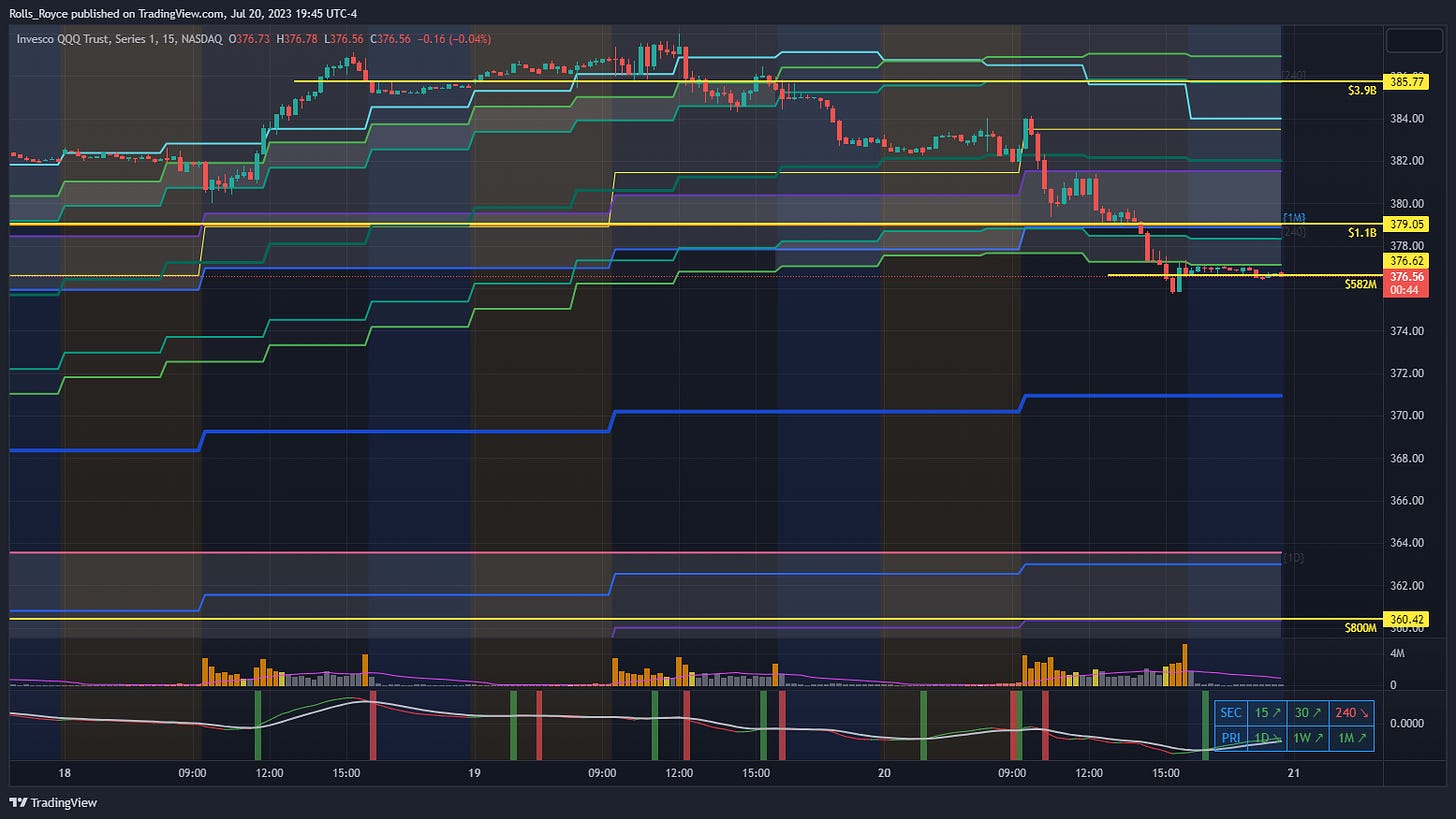

QQQ under important level. Bearish. Keep watching 385.77

Macro trend down on a flat day. Bearish.

Realtime look like sells. Bearish

Interesting SMH trade at 159.88. Probably our best clue of the day. I’m guessing this is bearish.

Close prints high volume MSFT & GOOGL.

Thursday

Great clues yesterday for today’s trading.

QQQ never got close to yesterday’s levels.

SPY levels contained the day

SMH same story as QQQ

SPY PRINTS

Not much SPY volume.

<For new subscribers, this is where the free content ends>

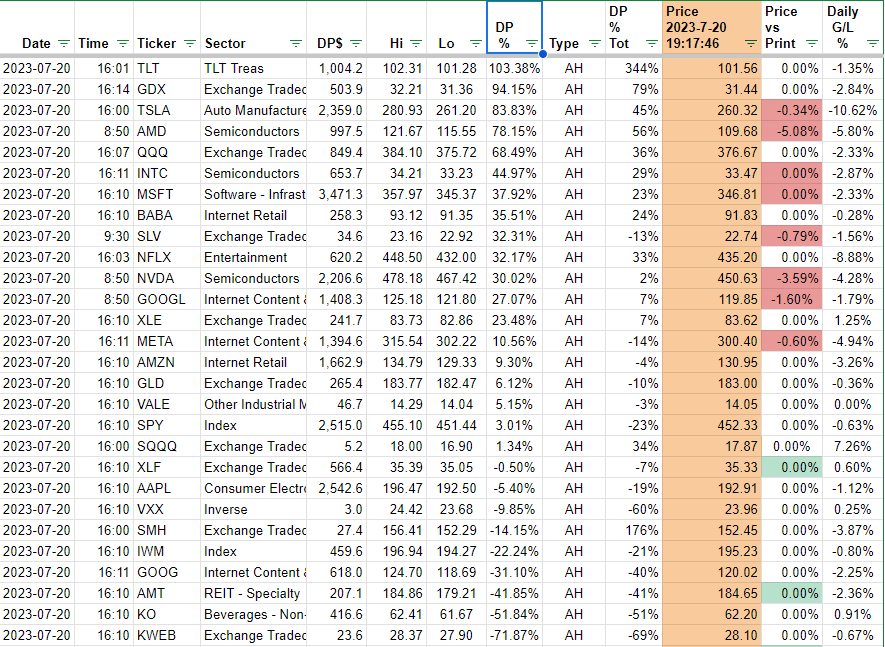

QQQ PRINTS

More trades coming in around 385. Almost $4B total, serious selling looks like.

Notice we don’t have massive trades at the lows.

MACRO TREND

Normal sell day.

LARGE PRINTS

More SMH today.

Megacaps do not have massive volume on a big sell day, which is interesting.

UNUSUAL PRINTS

Crazy huge TLT, could be buying. Watch 101.68

CLOSE PRINTS

More TLT at the close. Wow. Almost $3B today. Are they buying?

Megacaps & Semi’s have high volume at the close, could be dip buying.

SUMMARY

SPY hugging weak level at 452. If that breaks, we could see 450 again.

QQQ under recent levels. Watch weak level 376.62. Good support at the 20 day moving average at around 372.

Macro trend sell day.

Realtime prints not high volume on megacaps. That could mean we don’t get a sustained move down. Very large TLT trades today, looks like the boys are building a base here.

Interesting SMH trade at 155.34.

Close prints high volume megacaps, could be sneaky buying. Closing price on the megacaps would be good levels to watch.

RR oscillator. I’ll post this for a little while and see how it develops.

4hr timeframe: Up (bullish), 105

daily timeframe: Up (bullish) 296

We got the pullback I have been talking about for the last 2 days. Overall breadth is still good. Are they done? My gut says maybe not. Keep watching levels.

Rolls

SPY

QQQ

SMH

You mean the more print in this dates the less important.

Do the OPEX or EOM have an impact on significance of Close Print?