Intro

Friday

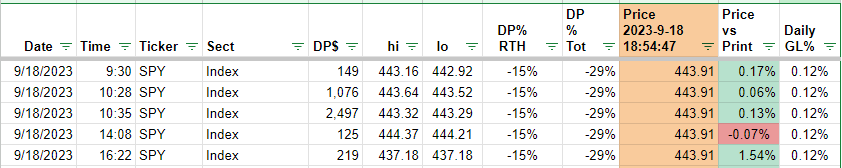

Here are the large trades again. Red.

Many times, I’ve seen the big money position on Quad Witch days. I’ve also seen them drop the market (usually not this much), buy the lows, and then resume an uptrend.

Remember me talking about “a pullback that no one wants to buy” on Thursday? Friday tested the September 7 lows and also the 50% retrace of the run up from August 15.

The pivot now is very simple. SPY 443.28. Over that, we might get bullish again. Under that level, SPY does not have good support until about 438.

Monday

Folks we went nowhere again today. SPY is barely holding over my pivot at 443.28.

What’s A Swing Trader To Do?

Many of you know that my style is a swing trader. I mostly trade long, and typical hold is 2 days to 8 weeks. I look for 5-15% gains. In times when SPY meanders around for days or weeks, swing traders need to adjust. Adjust what?

I like trading 30 minute charts, and my lowest timeframe indicator is 4 hours. I like trading based on daily indicators. What do you do when the daily indicators don’t fire? You either have to lower your timeframe or sit on your butt and wait. If patience isn’t one of your strengths, you trade a lower timeframe. Instead of taking profits on a daily Bollinger band, Keltner, or moving average, you can lower the timeframe to 4 hours or 30 minutes. Some of my friends know that I have a megacap chart based on 30 minute Keltners that can be used to trade QQQ or NQ.

With lower timeframes, you can lock in profits on a smaller move, but with the risk of missing the larger move.

SPY PRINTS

More trades at 443. $7.6B in the last 2 trading days.

Keep reading with a 7-day free trial

Subscribe to RollsRoyce’s Darkpool Trading to keep reading this post and get 7 days of free access to the full post archives.