Note From Rolls

People have asked how I’m doing. Answer is about the same which isn’t all that good.

The good news is that I have an assistant pulling data for Substack. The issue is that my eyes can handle a limited amount of screen time before the migraine tide starts rolling in. My assistant is doing the repeatable and time consuming work, we do the levels together (he draws and I tell him where and how much), and the commentary is all me. The commentary will be limited for now.

SPY & QQQ levels have gaps, and that’s something I want to go backward and get for everyone.

The full Substack will be free until I feel good about consistency and my own ability to keep going.

Monday

No daily commentary today.

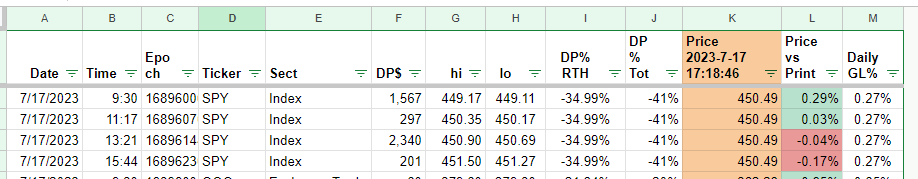

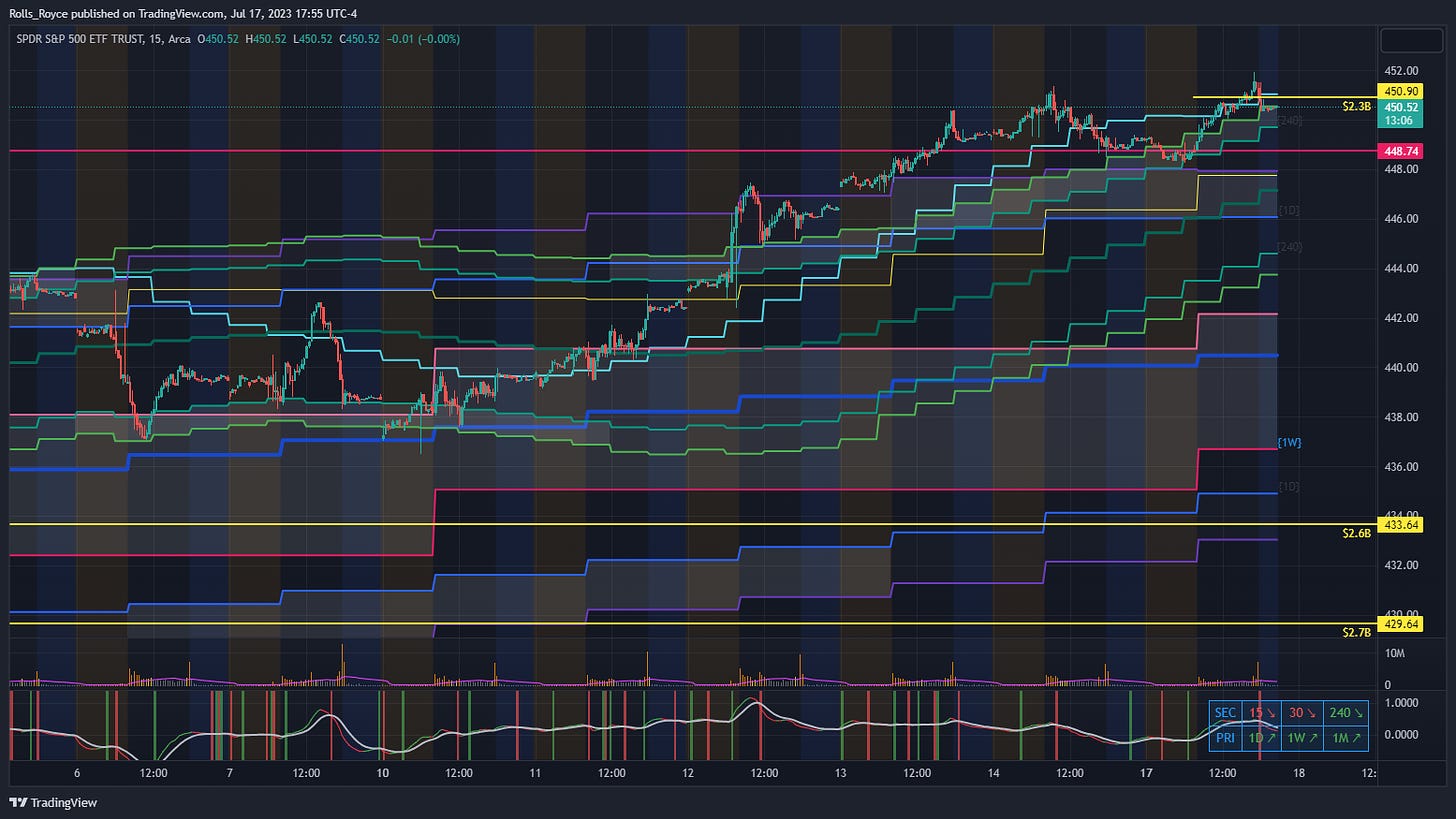

SPY PRINTS

Not much here. New level at 450.90.

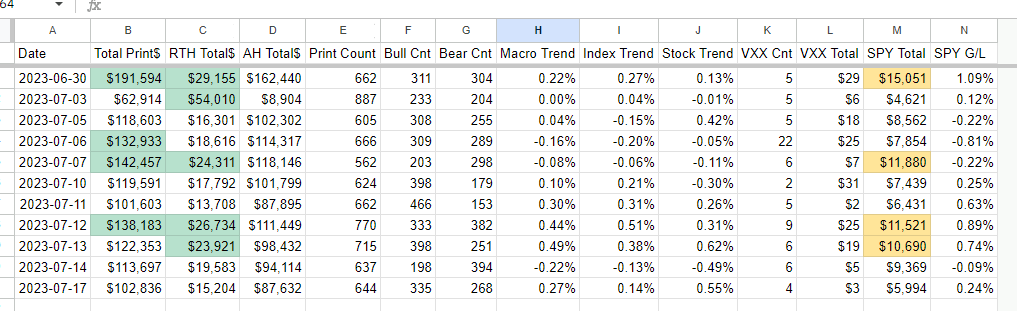

MACRO TREND

Macro stock trend buying. Normal volume.

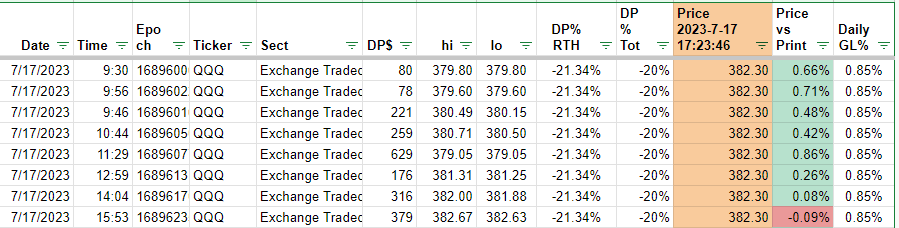

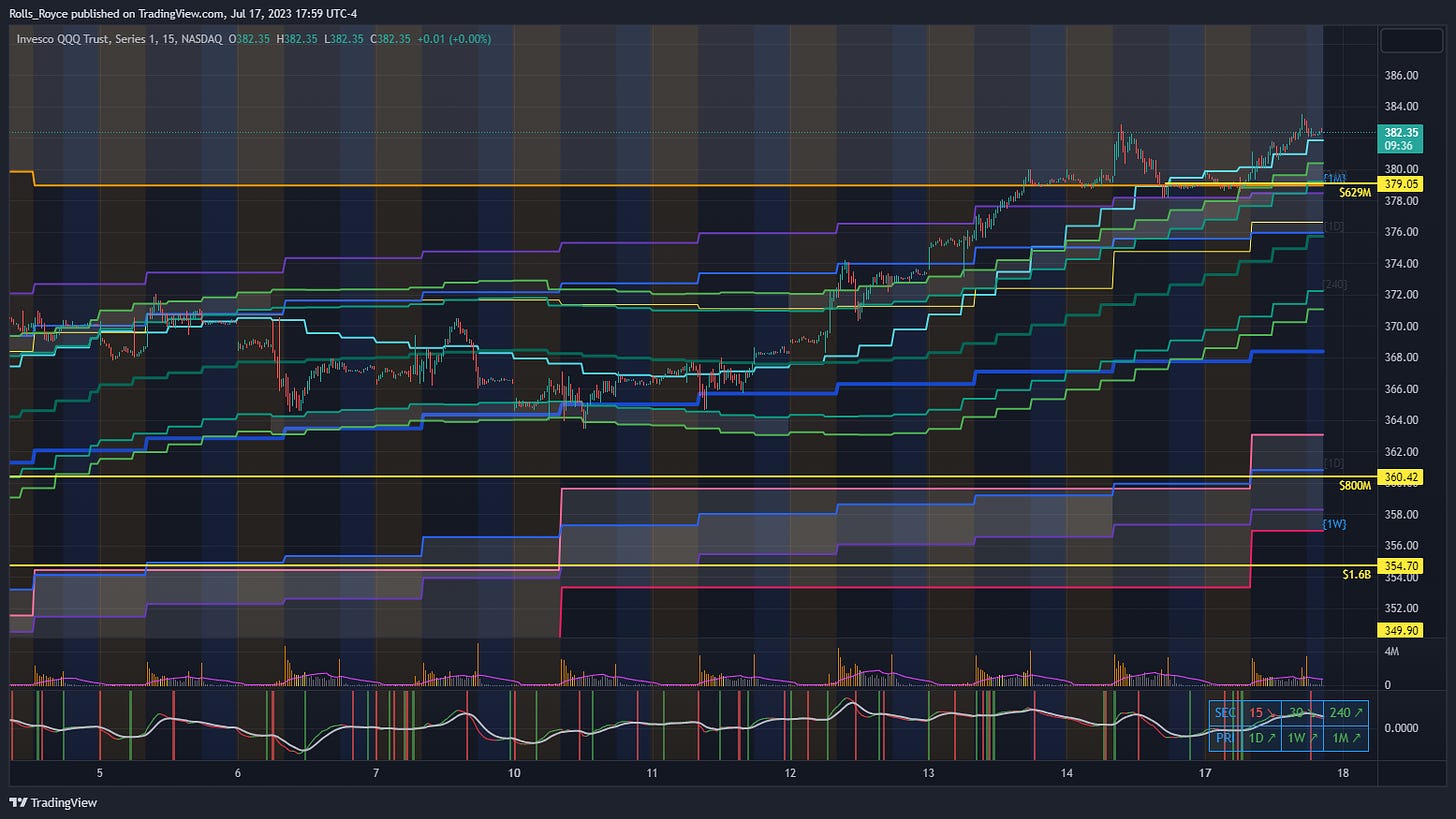

QQQ PRINTS

Good aggregate volume. “Buying the way up.” Bullish. New level at 379.05.

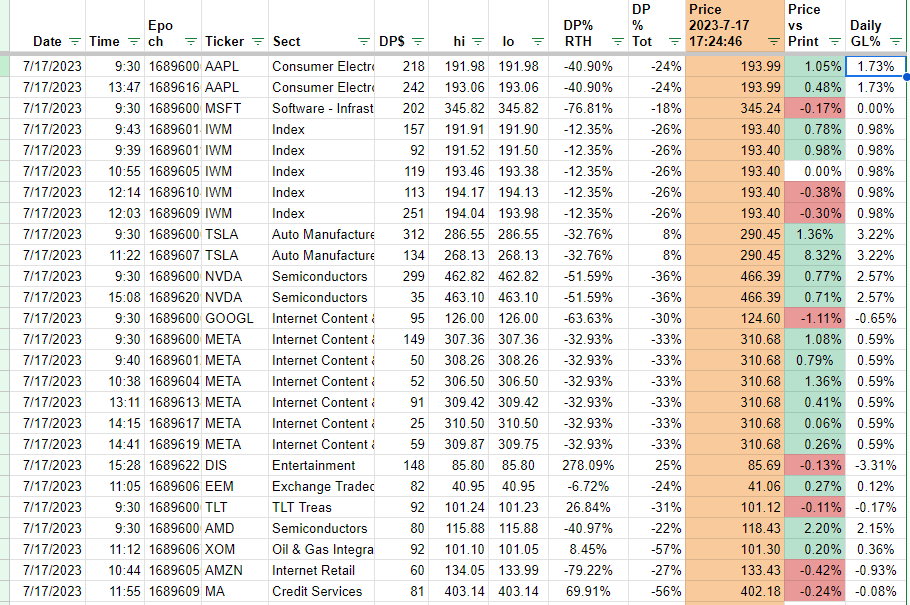

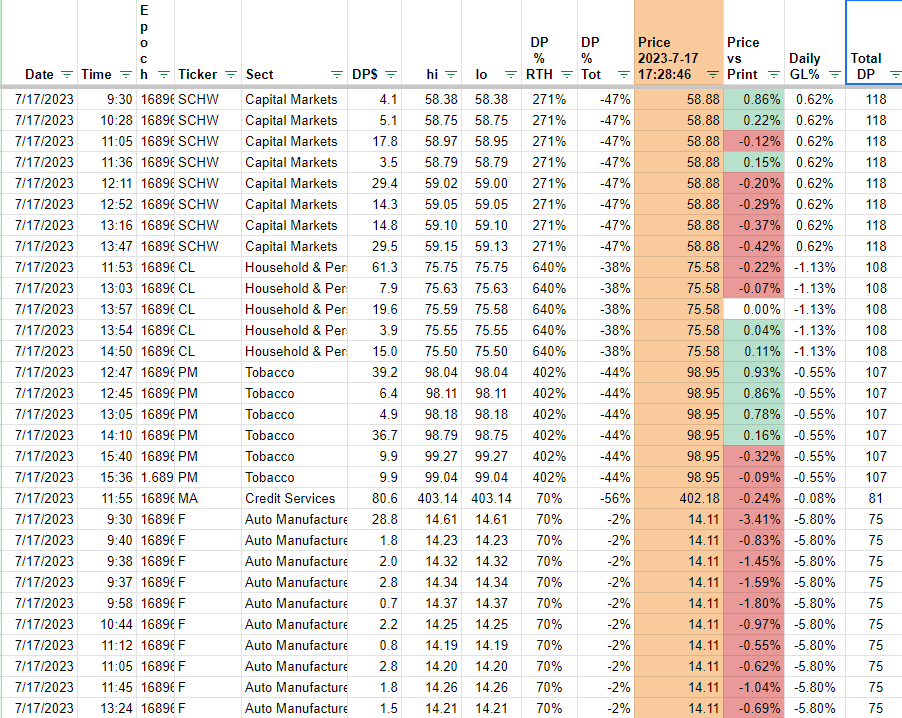

LARGE PRINTS

Good volume on AAPL, TSLA, NVDA, NVDA. Nothing particularly large. Bullish for the most part.

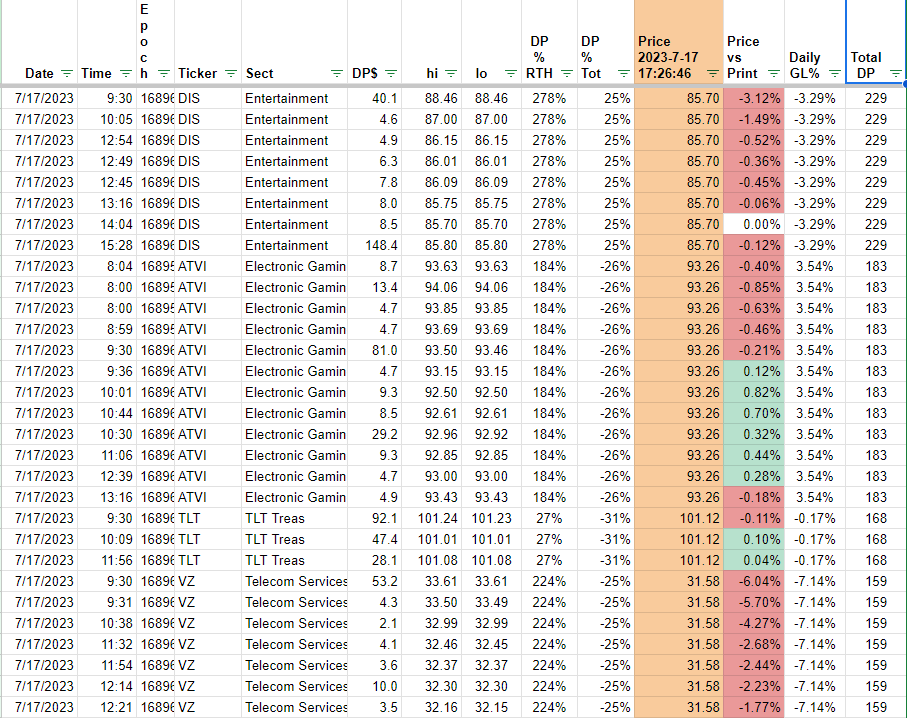

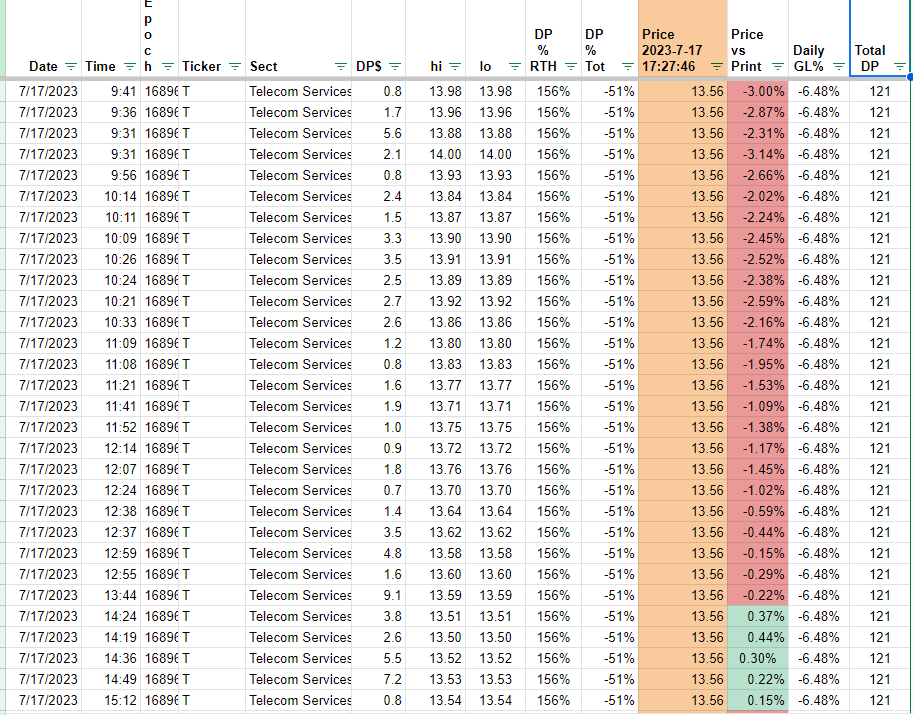

UNUSUAL PRINTS

Big volume on DIS. ATVI has a deal cooking, I’ll leave that one alone.

Large volume T & VZ for the big dump today.

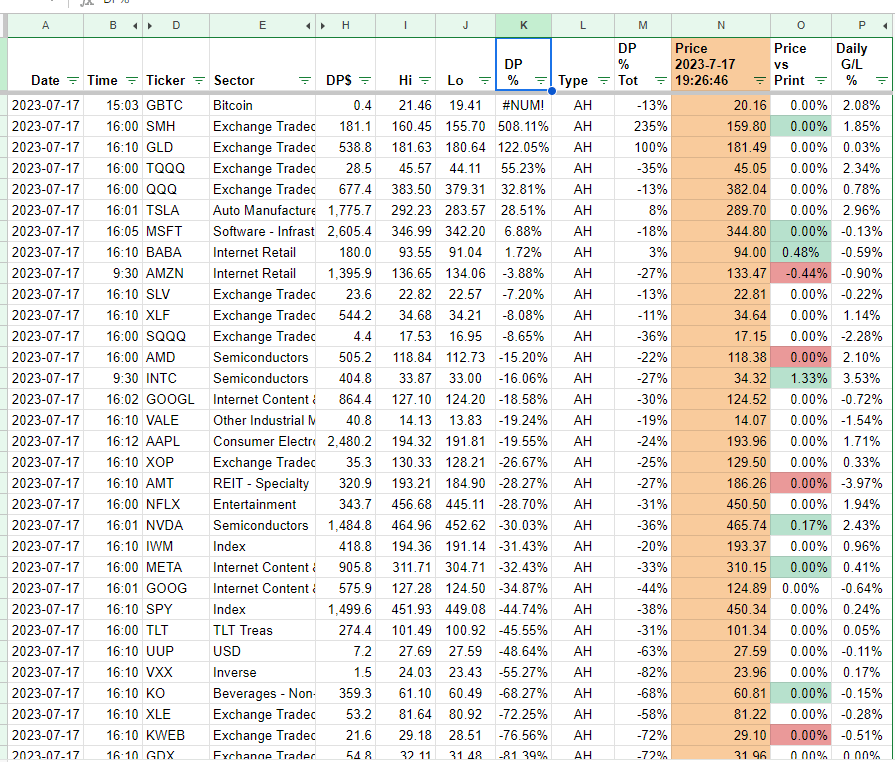

CLOSE PRINTS

Very large SMH. High volume QQQ & TSLA.

SUMMARY

SPY neutral. New level at 450.90.

QQQ “buying the way up.” Bullish. New level at 379.05.

Macro stock bullish.

Realtime prints bullish. Normal volume.

Close prints high volume SMH, QQQ, TLSA.

RR oscillator. I’ll post this for a little while and see how it develops.

4hr timeframe: Up (bullish), 160

daily timeframe: Up (bullish) 267

So far the RR 4hr indicator ranges between 400 and -400 under normal market conditions. Daily is higher than I’ve seen it before. Good breadth. The market probably wants a pullback soon to reset technicals.

Rolls

SPY

Need to fill in some of that blank space.

QQQ

Need to fill in some of that blank space.